Summer is officially here, and streaming providers are at the edge of their seats waiting to see if video streaming consumption will rise in the coming months, as it did last year, or if the remission of the Covid-19 pandemic and growing economic uncertainty will put an end to the party.

According to our data, streaming consumption, measured in average daily playtime per user and service, went up over 5% globally in the Summer of 2021 for both Linear TV and video on demand (VoD) when compared to the previous quarter.

In this blog, we leverage data from the NPAW Suite to dig into what happened last year and discuss how things might turn out this time around.

VoD saw increased demand in the Summer of 2021

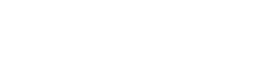

For VoD, global Summer consumption went up an average of 5.1% globally in 2021. Of the 5 regions examined (Asia, Europe, Pacific, Middle East, Latin America, and North America), all except the Pacific showed increased content consumption in the Summer months — i.e. a spike in Q3 2021 vs. Q2 2021 (Q1 2021 vs. Q4 2020 for the southern hemisphere Pacific).

Although NPAW’s Latin American data include some countries in the southern hemisphere, the region behaved collectively more similarly to those in the northern hemisphere.

The Middle East was the region that experienced the biggest uptake in engagement during the Summer with a 10.4% increase, followed by Europe (+8.6%), Asia (+7.8%), Latin America (+6.2%), and North America (+5.2%).

Meanwhile, the Pacific saw a 7.5% decrease in VoD consumption during the Summer (Q1 2024 vs. Q2 2020) while experiencing a 15.9% spike in Q3 2021 vs. 2021. In other words: the Pacific is the only global region that saw higher consumption rates during the Winter months compared with the Summer.

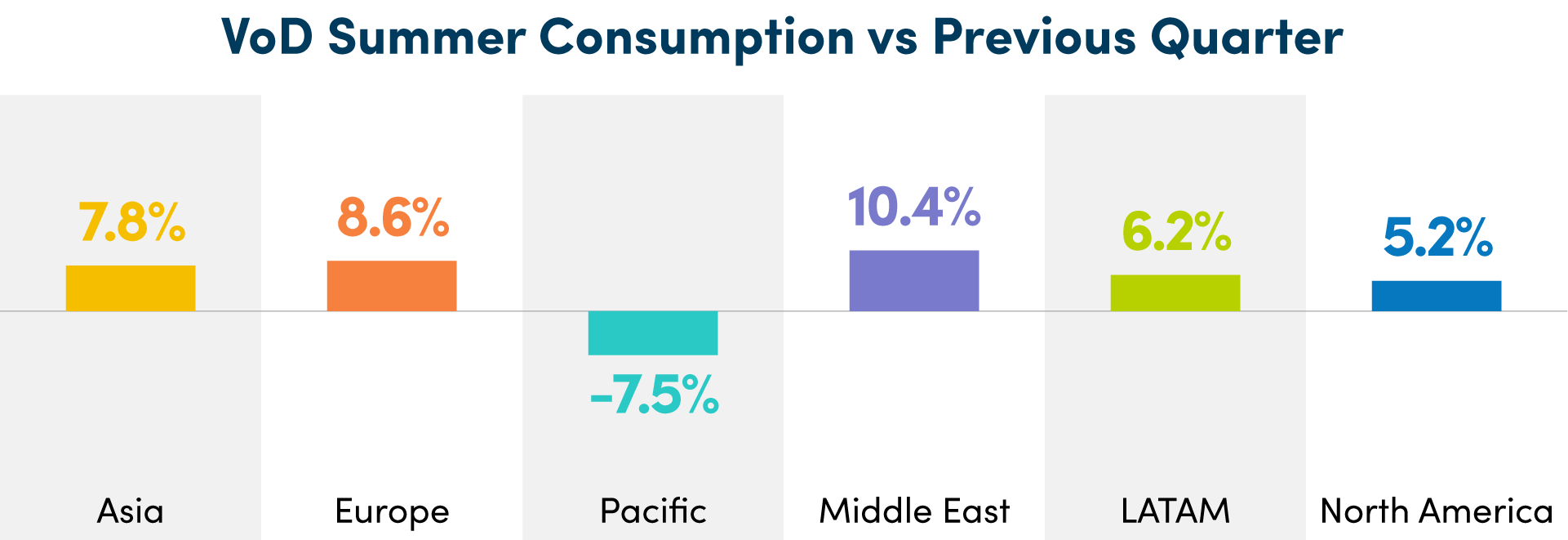

All five regions, however, experienced a significant drop in Q3 VoD consumption (over 11% in the Middle East and North America) in 2021 vs. 2020. These findings are consistent with NPAW’s 2021 Video Streaming Industry Report, which identified a global drop in VoD consumption per user in 2021 compared with 2020 due to increased competition between services.

Linear TV: a more local matter

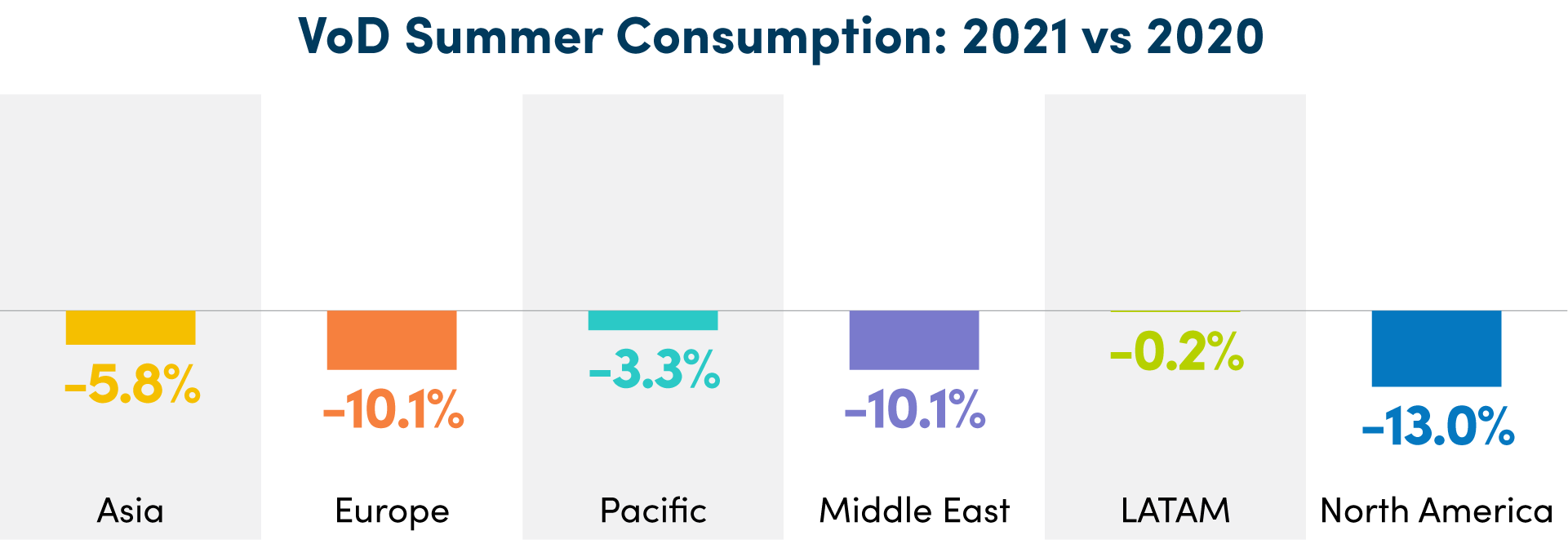

Linear TV Summer consumption went up by an average of 5.2% in 2021 — but regional data was more of a mixed bag.

Daily playtime per user and service was up in all regions during the Summer months of 2021 except for in North America, where there was a very slight reduction of two decimal points. Latin America was the region that saw the most significant increase in Summer consumption, seeing a 9.7% hike in Q3 2021 vs Q2 2021. It was followed by Asia (+7.4%), Europe (+4.7%), and the Middle East (+3.1%).

In contrast with VoD, the Pacific saw a very small increase (+0.2%) in Linear TV consumption during the Summer months. Yet not nearly as much as it did in the Q3 2021 vs. Q2 2021, confirming again that the Winter months were stronger in terms of consumption for the region.

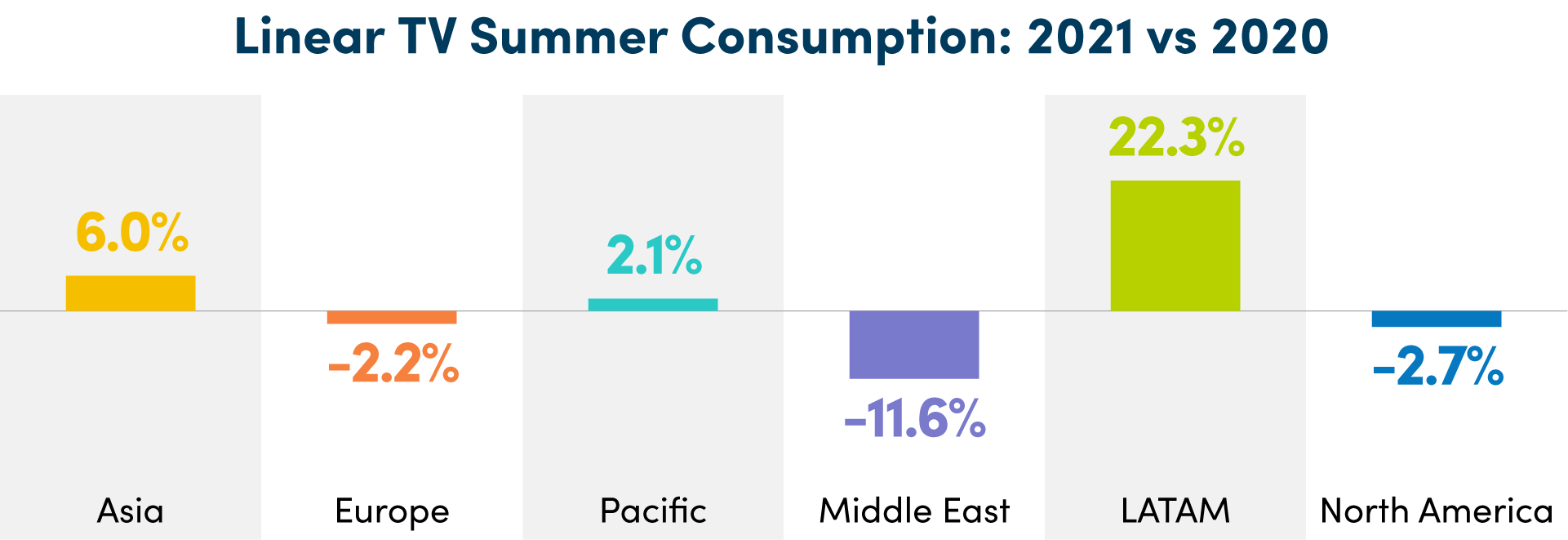

The comparison of Summer 2021 and Summer 2020 Linear TV consumption paints a rather disparate picture than that of VoD — a reflection of the local nature of Linear TV and regional trends of live content consumption.

Latin America saw a 22.3% increase in Linear TV Summer consumption in 2021 when compared to 2020, followed by Asia (+6%) and the Pacific (+2.1%). Meanwhile, Linear TV Summer consumption decreased by 11.6% in the Middle East in 2021 compared with the previous year, followed by North America (-2.7%) and Europe (-2.2%).

The impact of Covid-19 and rising temperatures

There are, then, two main takeaways from our analysis of last year’s consumption trends that can help inform what could happen in 2022.

First, that Summer video streaming went up when compared to the previous quarter all across the world except in the Pacific.

Second, regardless of the spike in consumption compared with the Spring months, global VoD saw far less Summer consumption in 2021 than it did in 2020, while Linear TV Summer consumption presented a more varied picture depending on the region.

As for the latter phenomenon, Covid-19 seems to be the main explanation.

Summer 2020 followed the hardest months of the pandemic, and the streaming boom was still in full swing. That, along with the widespread effects of increased competition between services in 2021, would explain why VoD consumption declined in the Summer of 2021 compared to the previous year. Consumers had more liberty to roam freely, so they spent less time at home.

The mixed picture of Linear TV consumption in 2021 vs 2020, beyond it being a type of content that depends on local events, can be explained by the different Covid-19 restrictions that were in place during the Summer of 2020 and 2021 respectively across regions. With linear TV being so tied to live events, this could explain why the consumption numbers are not as cohesive as in the case of VoD, which is not impacted as much when there is no fresh content being produced.

Finally, rising global temperatures could explain the apparently counterintuitive hike in streaming consumption for both Linear and VoD experienced during the Summer months compared with the Spring. The Summer of 2021 was the hottest one on record in regions like the United States and Europe, which could have pushed people toward indoor entertainment and the comfort of air conditioning.

The Pacific, however, remains an anomaly as the only region to experience less consumption in the Summer months compared with the previous quarter. Unfortunately, weather records are not too helpful here, as, like in many other regions, areas of the Pacific like Australia suffered a hotter-than-average Summer in 2021.

What Summer 2022 might hold

So what does all this tell us about this Summer?

Let’s start with what we already know: Summer 2022 is expected to be hotter than previous ones and bring yet another round of record high temperatures. This, in theory, should drive people indoors and potentially increase video streaming consumption. But there are other factors at play.

With Covid-19 restrictions almost a thing of the past, this will be the first Summer since 2019 to experience a full-blown return to mass events, traveling, and, overall, the old normal. This could negatively impact streaming consumption as people devote their time to other endeavors.

Finally, there is the economic question. With growing inflation and pressure on the global economy, household budgets are tightening. The current economic climate could force consumers, who have been stacking subscriptions until now, to drop those services they consider they can do without.

So, nothing more to do than wait to see what happens. But stay tuned. We’ll be following this article with the actual Summer 2022 numbers once August is over.